🔥 Week 16 CryptoCurated: Rate Cuts, Bitcoin Dominance, and MSTR Goes Full Degenerate 🔥

Welcome back, degenerates and diamond hands! It’s FOMC Week, and Jerome Powell’s half-hearted 0.25% rate cut seems to have left markets unimpressed.

Bitcoin, Solana, and RUNE took a little dive—no surprises there, the algos move faster than Powell’s mumblings.

Let’s dive into this week’s hottest action:

📊 FOMC and Market Reaction

The Federal Open Market Committee (FOMC) quarter-point cut today may mark the start of rate easing, but don’t expect the liquidity spigot to open just yet. Markets had baked in something juicier, so:

📉 Weekly Price Recap

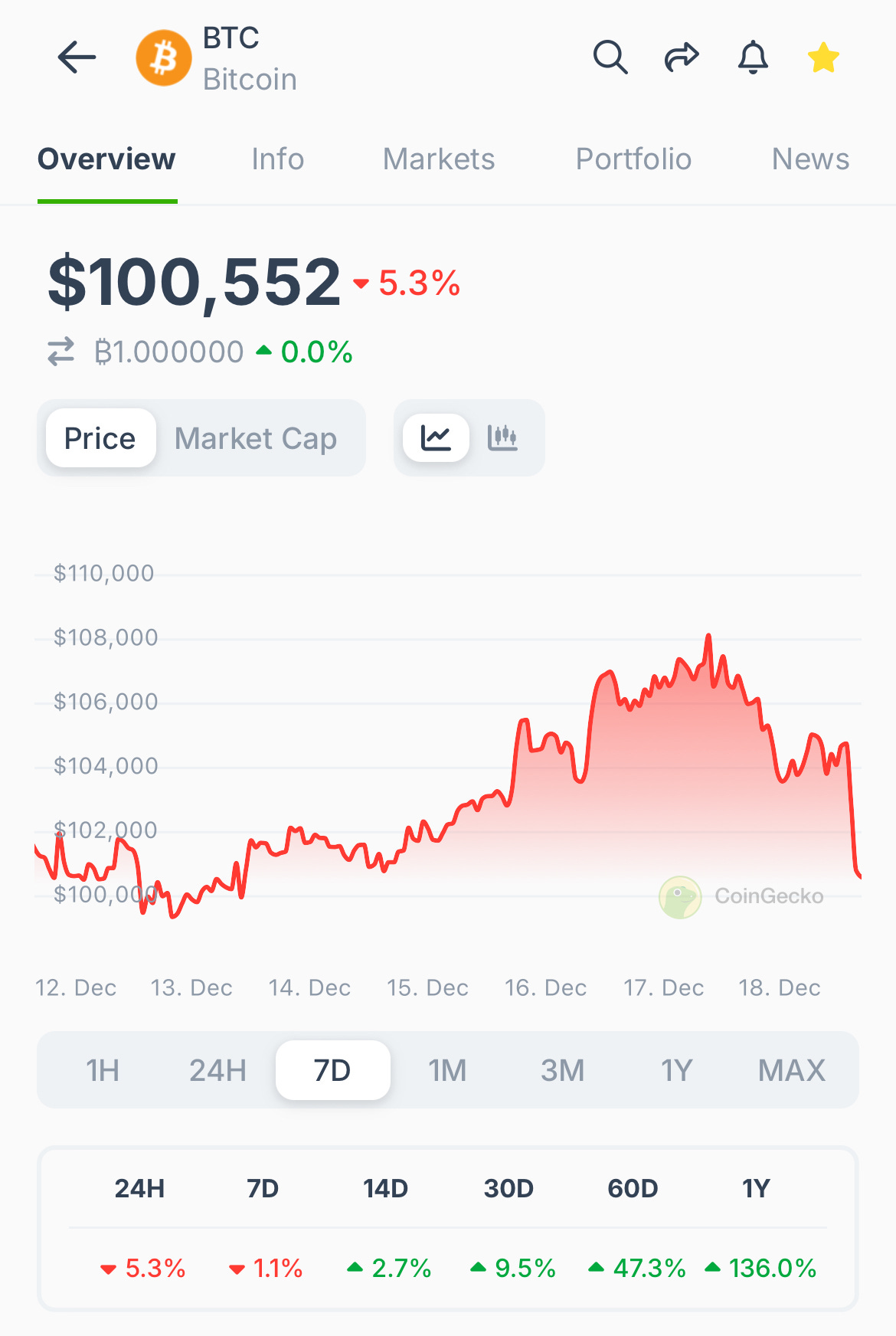

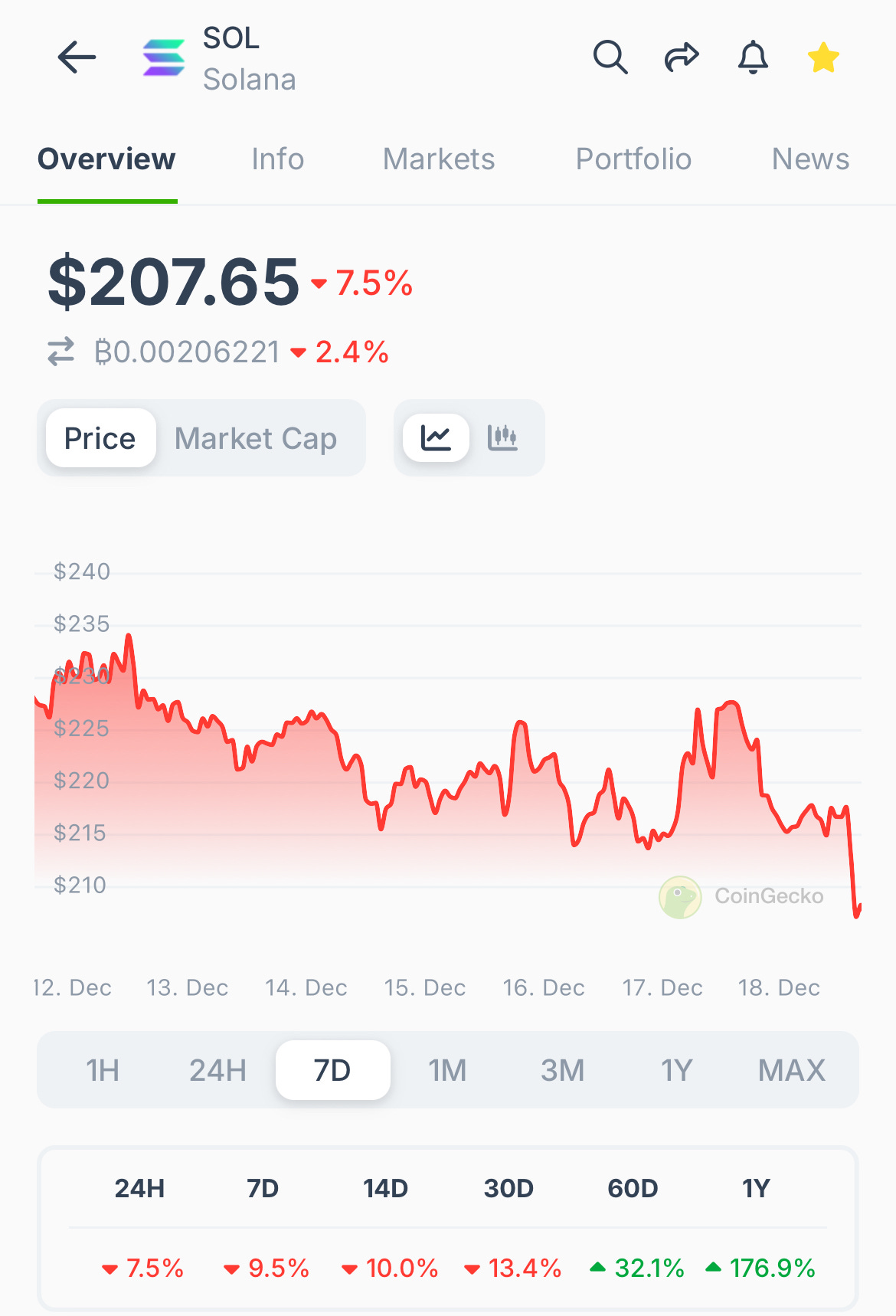

Asset Price Weekly % Change

BTC $100,552 -1.1%

SOL $207.65 -9.5%

RUNE $5.97 -6.1%

The FOMC fallout took a toll on prices, but long-term narratives remain intact.

TL;DR: The rate cut disappointed. Crypto sold off, but this dip might be your “thank you, Powell” moment.

🏦 MicroStrategy (MSTR): Bitcoin Holdings Go Full Tilt

Michael Saylor is back at it, making MicroStrategy the Bitcoin-buying machine we all know and love:

• Bitcoin Holdings Surge: Over the past 40 days, MicroStrategy has added 40% more BTC, cementing its dominance as the largest corporate Bitcoin holder.

• Numbers: The company now holds 439,000 BTC, worth over $45B. The latest purchase? 15,350 BTC for $1.5 billion at an average price of $100,386/BTC.

• Funding Madness: They sold equity shares (again) to bankroll this buying spree. Meanwhile, MSTR stock surged. Whether this is brilliance or insanity depends on which way Bitcoin goes next.

• The Flywheel: If MicroStrategy gets added to the Nasdaq 100 on Dec 23rd (announcement likely soon), ETFs could pile in with up to $2.1B in MSTR buys. MSTR currently trades at a 147% premium to Bitcoin NAV, and no one seems to care.

Sources: Bernstein, Bloomberg.

Takeaway: Saylor’s strategy is clear—print shares, stack sats, repeat. At this point, MicroStrategy is a leveraged Bitcoin ETF in disguise.

🌊 THORChain and RUNE: Incentives Heating Up

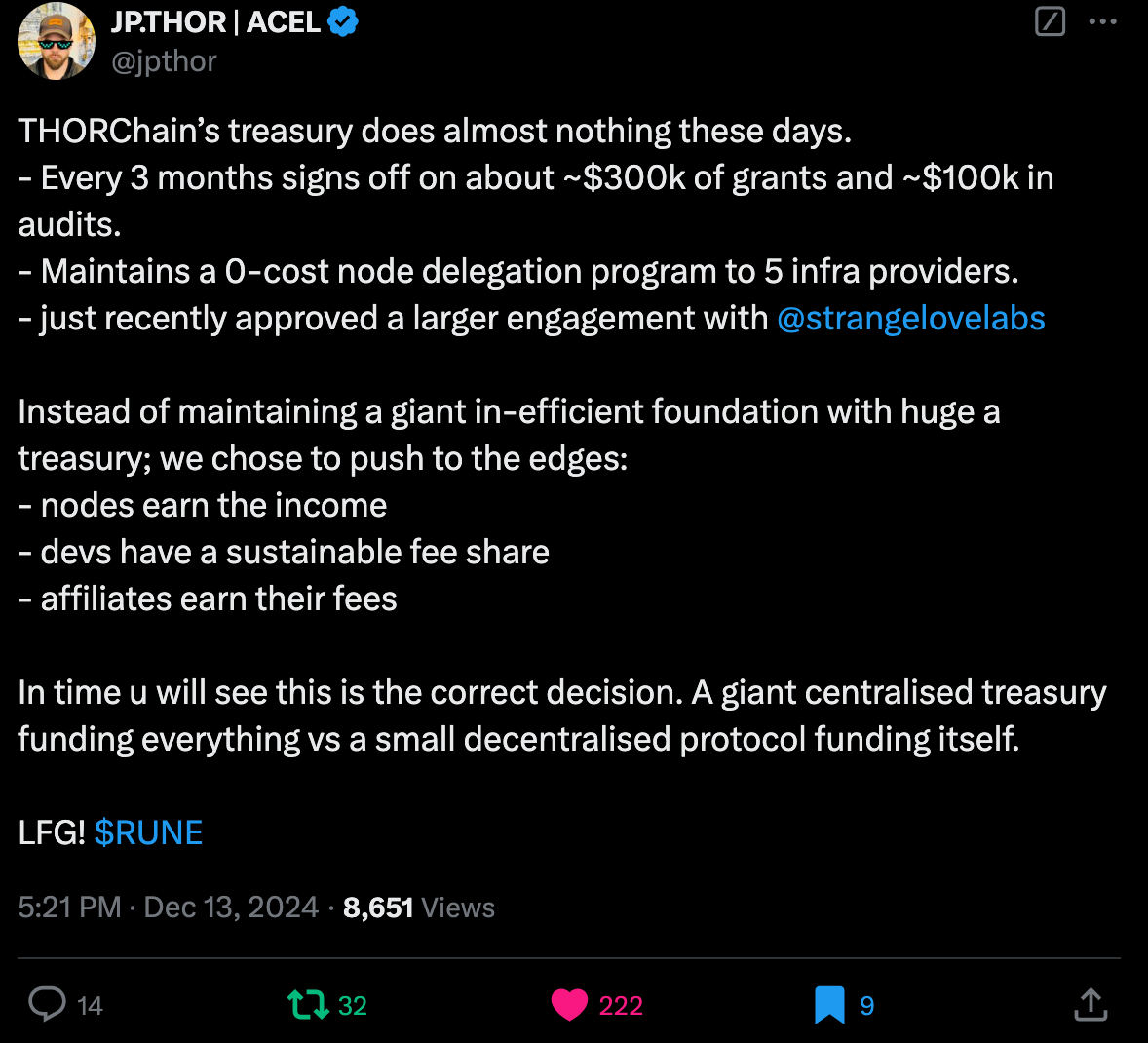

• RUNE Incentives: THORChain announced a $20M+ incentive program for affiliates to drive deeper adoption. Source: JP Thor.

• Burn Mechanics: With its burn mechanics cranking up, RUNE’s supply continues to deflate, putting bullish pressure long term.

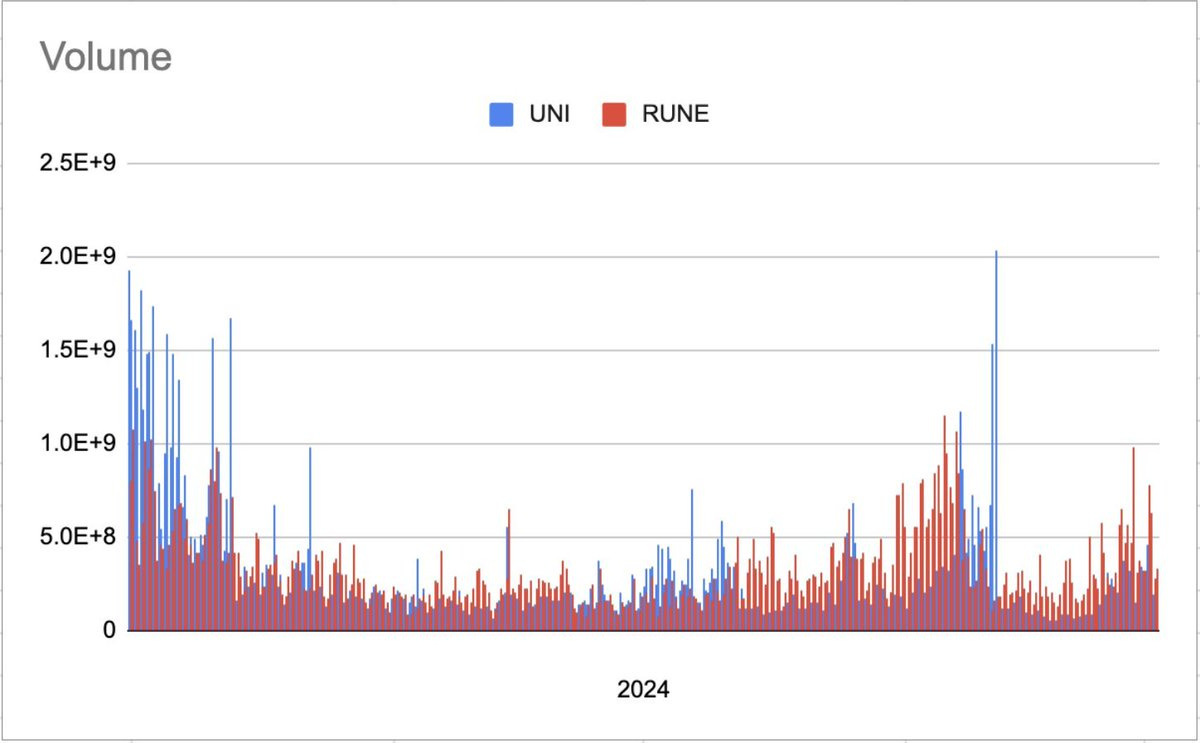

• Volume Comparisons: RUNE’s DEX volume continues to challenge UNI, despite a 5x difference in market cap. Source: AstroBoy Post.

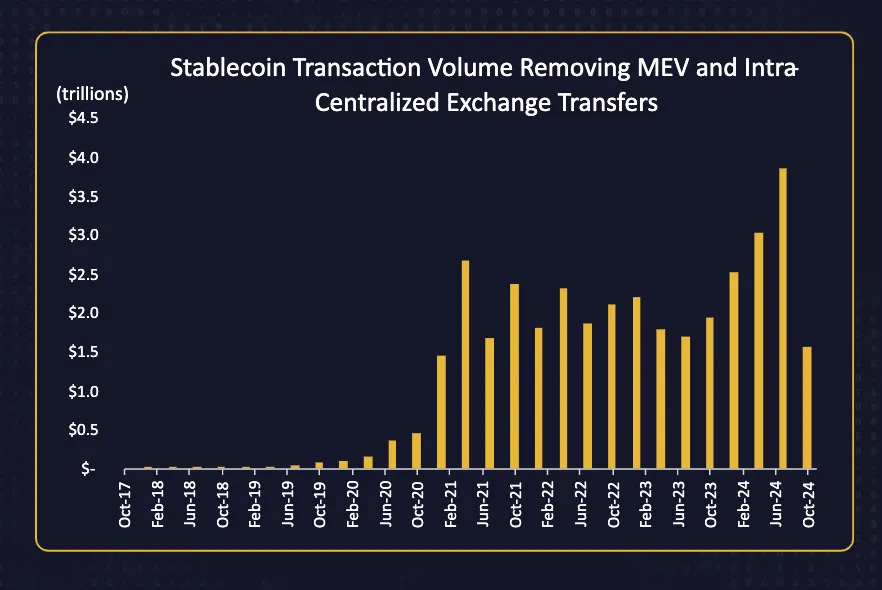

🚀 Stablecoin Explosion: $4 Trillion on Deck?

Stablecoin transaction volume is hitting all-time highs, driven by DeFi and global liquidity needs:

• Volumes are back near the $4 trillion mark, with robust on-chain demand outside centralized exchanges. Source: Paul Veradittakit.

The stablecoin growth story is now hard to ignore.

🛠️ TradFi vs. DeFi: Battle Intensifies

DeFi Gains: RENDER (RNDR) and KMNO are flying under the radar. Dig in before TradFi finally wakes up. KMNO Info.

💼 Wallet & Exchange Section

🔗 Tools for degens to thrive:

• Wallets: xDeFi, Edge, THORWallet.

• Exchanges: Binance, KuCoin, Kraken.

Why It Matters: Wallets for self-custody, CEXs for liquidity—know your tools, protect your keys.

📈 BTC Dominance Rises Amid ETF Inflows

• Bitcoin dominance climbed to 57.84%, fueled by ETF demand and stablecoin inflows. The Bitcoin ETFs continue to gobble up BTC like it’s a limited resource (spoiler: it is).

🚀 Final Thought:

As Saylor keeps buying, ETFs keep flowing, and DeFi keeps innovating, the power struggle between TradFi and crypto intensifies. A correction? Sure. But let’s not forget the Bitcoin ETF only launched this year.

The bull is resting, not dead.

Until next week—stay curious, stay bold, and keep stacking.

🔗 Follow us for more: CryptoCurated.

Disclaimer

CryptoCurated is for educational and entertainment purposes only. The information provided does not constitute financial or investment advice. Please conduct your own research or consult a professional advisor before making any investment decisions.

Great stuff!

No Doubt, ETF only this year. Still early!! Awesome info, Ty